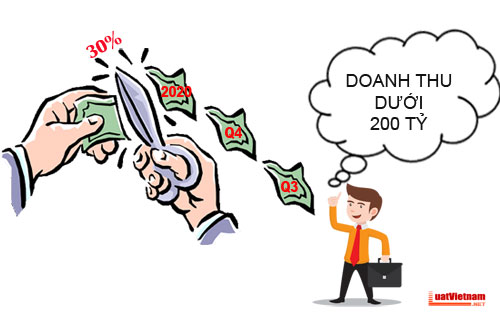

Ngày 19/06/2020, Quốc hội đã đưa ra Nghị quyết số 116/2020/QH14 về giảm 30% số thuế thu nhập doanh nghiệp phải nộp của năm 2020 đối với trường hợp doanh nghiệp có tổng thu năm 2020 không quá 200 tỷ đồng.

Theo Điều 1 của Nghị quyết này, quy định đối tượng áp dụng đối với người nộp Thuế TNDN là tổ chức hoạt động sản xuất, kinh doanh hàng hóa, dịch vụ có thu nhập chịu thuế theo quy định của Luật Thuế TNDN bao gồm 4 nhóm: – Doanh nghiệp được thành lập theo quy định của pháp luật Việt Nam; – Tổ chức được thành lập theo Luật Hợp tác xã; – Đơn vị sự nghiệp được thành lập theo quy định của pháp luật Việt Nam; – Tổ chức khác được thành lập theo quy định của pháp luật Việt Nam có hoạt động sản xuất, kinh doanh có thu nhập.

Quốc hội quyết nghị giảm 30% số Thuế TNDN phải nộp của năm 2020 đối với trường hợp doanh nghiệp có tổng thu năm 2020 không quá 200 tỷ đồng. Doanh nghiệp căn cứ quy định ở trên để tự xác định số thuế được giảm khi tạm nộp thuế thu nhập doanh nghiệp theo quý và quyết toán thuế thu nhập doanh nghiệp năm 2020.

Nghị quyết này có hiệu lực thi hành sau 45 ngày kể từ ngày ký và áp dụng cho kỳ tính thuế 2020.

=> Tải Nghị quyết 116/2020/QH14 tại đây!

Leave a Reply